georgia film tax credits for sale

Georgia doled out a record 12 billion in film and TV tax credits last year far surpassing the incentives offered by any other state. How-To Directions for Film Tax Credit Withholding.

Georgia Film Industry Leaders Believe Tax Incentives Are Crucial To Continued Success Atlanta Business Chronicle

Paying less on Georgia income tax.

. The final tax credit sale to folks like you and me is usually at about a 10 discount so you would buy each 100 of Georgia tax credit for about 090. The state of Georgia offers tax credits of up to 30 percent of film and entertainment project expenditures as an incentive to encourage producers to invest in the state and contribute to its economy. Money to buy the credits.

Register for a Withholding Film Tax Account. The Georgia Entertainment Industry Investment Act GEIIA gives a 20 tax credit to companies that spend 500000 or more in Georgia during production and post-production. Sold Millions of Illinois credits specializing in tax credits for television and commercial projects.

All production and post-production expenses must be in the state. The broadening of this legislation permits a Georgia corporate fiduciary or individual taxpayer to purchase these credits to offset their Georgia income tax liability. An additional 10 percent uplift can be earned by including an embedded animated or static Georgia.

There are three main benefits for purchasing Georgia Entertainment Credits. Claim Withholding reported on the G2-FP and the G2-FL. Includes a promotional logo provided by the state.

We offer film tax credits in various states to offset individual income tax corporate income tax and premium tax. In order to qualify individuals or corporations need to have. The-board flat tax credit of 20 percent to certified projects based on a minimum investment of 500000 over a single tax year on qualified expenditures in Georgia.

The production company can sell the credits to raise capital to offset expenses of the production and ultimately lower their budget. Unused credits carryover for five years. The program is available to production companies that spend at least 500000 on production and post-production in Georgia either in a single production or on multiple projects.

On average 1 of Georgia Film Tax credit can be purchased for 087 to 090. You will receive a red errorwarning message about K-1s which you can ignore. Most of the credits are purchase for 87-92 of their face value.

All project types are eligible for Georgia film tax credit including game shows talk shows and reality TV. Third Party Bulk Filers add Access to a Withholding Film Tax Account. Tax The Georgia film credit can offset Georgia state income tax.

Offset up to 100 Corporate Income Tax 100 Personal Income Tax. For example an individual purchases 1000 of Georgia film credits and had a 600 Georgia income tax liability for the year and had 500 Georgia withholding from their wages. Placed over 35 Million of Georgia Film Tax credits with buyers in 2015.

The state has issued over the past decade. Taxpayers will pay for a tax credit and receive anywhere from a 5 to 15 discount on the value of the film tax credit depending on the state tax year amount and seller profile. Getting a state tax deduction on Schedule A of your Form 1040 for the credits purchased.

Production companies get a minimum of 20 tax credit. How to File a Withholding Film Tax Return. Qualifying Projects 20 tax credit is provided for companies that spend 500K or more on production and post production in Georgia.

The credit would offset the Georgia liability of 600 while 400 of the credit would carry forward to the subsequent tax year. The Georgia Department of Economic Development provides 20 of production expenditures in transferable tax credits for feature films television series. The tax credit gets entered into the the step-by-step under Georgia Business and K-1 Credits.

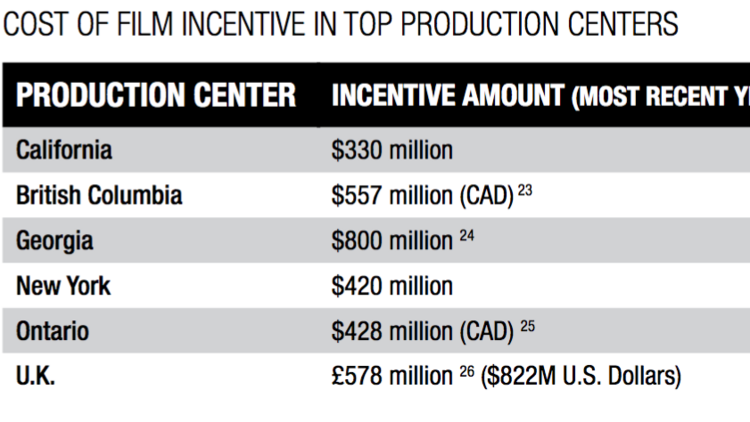

At 900 million the ceiling on Georgias program would still be more than double Californias offering. The proposed changes which would have capped tax credits at 900 million a year and banned film companies from selling the credits to third parties had. June 3 2019 1217 PM.

A Georgia taxpayer may purchase Georgia Entertainment Credits generally for around 88 per credit and apply them to their current year or future tax returns. Please note that discounts fluctuate. Learn what we do.

Multiple multi-Million Dollar sales in Louisiana including a 23 Million Dollar Louisiana Film Tax Credit sold for. The figure is 40 higher than the states. Instructions for Production Companies.

Selling Georgia Film Credits. This can include a single production or the total of multiple projects aggregated in a single tax year. Offset up to 100 Corporate Income.

The state grants an additional 10 credit if the company uses the Made In Georgia logo in its film credits. Credit Code 122 company name is the movie company no certificate 100 owner Federal EIN No and Credit Amount. The 500 of withholding would be eligible for a refund.

So for example if you had a Georgia income tax liability of 50000 you could purchase enough credits at 89 of there value that would equal 44500. Heres a Georgia film tax credit example. This 50000 would apply to current year or prior year taxes owed and any remaining amount could be carried over up to five years.

Georgia S Film And Tv Tax Credit Hits Record 1 2 Billion In Reimbursements

Film Tax Credits A Complete Guide Filmmaking Lifestyle

Essential Guide Georgia Film Tax Credits Wrapbook

Essential Guide Georgia Film Tax Credits Wrapbook

Film Industry Tax Incentives State By State 2022 Wrapbook

Film Digital Media Tax Credits Clocktower Tax Credits Llc

Film And Tv S Tax Credits A State Guide To Competition The Hollywood Reporter

Georgia Tax Breaks Don T Deliver Georgia Budget And Policy Institute

Georgia Scrap Bill That Would Have Capped Its 900 Million Film Incentives Deadline

Essential Guide Georgia Film Tax Credits Wrapbook

Georgia Senate Panel Proposes 900 Million Cap On Film Tax Credit Variety

Georgia Tax Breaks Don T Deliver Georgia Budget And Policy Institute

Sugar Creek Capital Film Entertainment Tax Credits

Audits Becoming Mandatory For Georgia S Film Tax Credit Mauldin Jenkins

Essential Guide Georgia Film Tax Credits Wrapbook

Tax Incentives For Film Production We Ve Seen This Movie Before Wsj

Sugar Creek Capital Film Entertainment Tax Credits

Georgia No Longer No 1 In Feature Film Production Atlanta Business Chronicle